Traditional remittance giants like Western Union and MoneyGram are struggling to keep pace in an evolving financial ecosystem increasingly shaped by stablecoins.

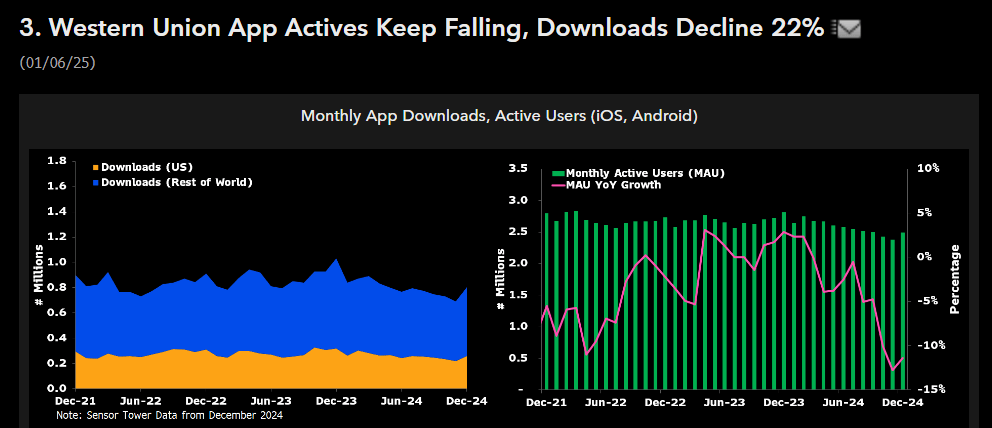

According to Matthew Sigel, Head of Digital Assets Research at VanEck, downloads of remittance giants apps have dropped significantly, with Western Union seeing a 22% decline and MoneyGram experiencing a 27% reduction.

Meanwhile, this drop isn’t limited to app downloads. The number of monthly active users (MAU) engaging these platforms has remained under 3 million since 2021. From January to November 2024, these platforms have faced steady declines in user activity, signaling a shift in consumer behavior.

The rise of stablecoins

Sigel suggested that stablecoins are emerging as a powerful alternative to traditional remittance methods by offering faster, cheaper, and more accessible cross-border transactions.

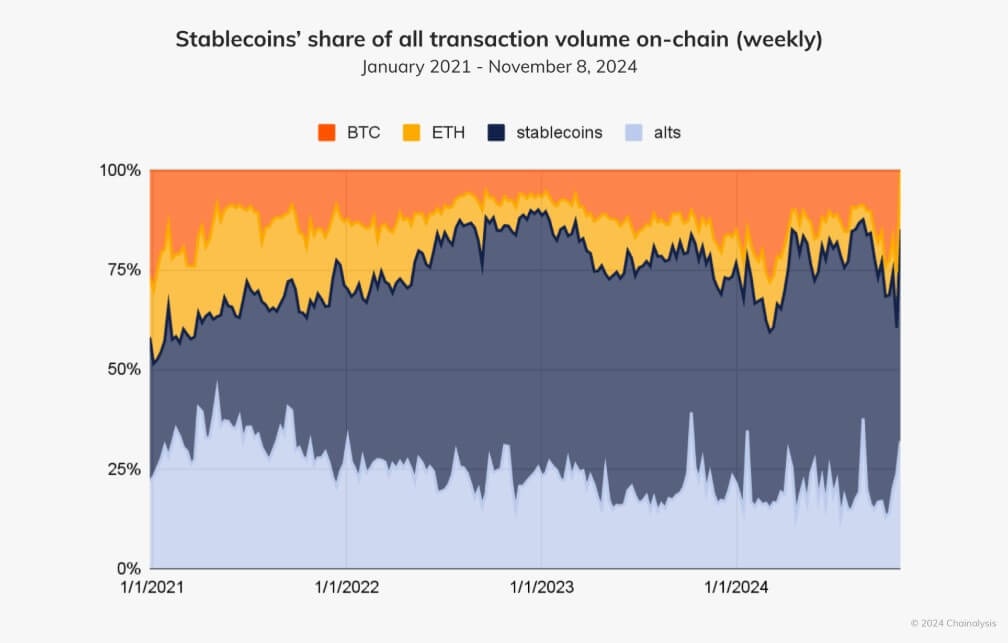

Blockchain analysis firm Chainalysis reported that these digital assets, which are pegged to stable values like the US dollar, have become indispensable in regions facing currency instability or limited access to reliable banking systems.

The global adoption of stablecoins continues to grow as they fill gaps left by traditional financial services. Individuals and businesses use stablecoins for international payments, protect wealth from currency fluctuations, and manage liquidity efficiently.

Unlike traditional banking, stablecoins enable instant transfers, sidestepping the delays and high fees associated with the older system.

In 2024, the stablecoin market hit a milestone, surpassing $200 billion in capitalization. The sector also saw the rise of innovative digital currencies like Ethena’s synthetic USDe stablecoin, which now competes with major players such as Tether (USDT) and Circle (USDC).

Moreover, the profitability of the stablecoin industry is equally notable, with issuers like Tether and Circle collectively earning over $664 million last December—representing a significant portion of the revenue generated by crypto protocols.

Furthermore, Chainalysis pointed out that stablecoins are responsible for over 75% of the trillions in crypto transactions recorded in recent months.

This remarkable growth has attracted attention from traditional financial institutions and blockchain companies, including Ripple, which are exploring ways to tap into this booming market.

Considering this, Liz Bazurto, the ecosystem engagement manager for MetaMask, said the traditional remittance giants might embrace stablecoin payments for their operations. She said:

“I can see a path for Western Union and MoneyGram to enable Stables. MoneyGram has enabled Stellar (USDC) for on and offramps.”

The post Western Union and MoneyGram app usage drops as stablecoin adoption surges appeared first on CryptoSlate.