Bitcoin traded around $96,500 Tuesday following the release of US December Producer Price Index (PPI) data, which indicated a deceleration in producer price growth.

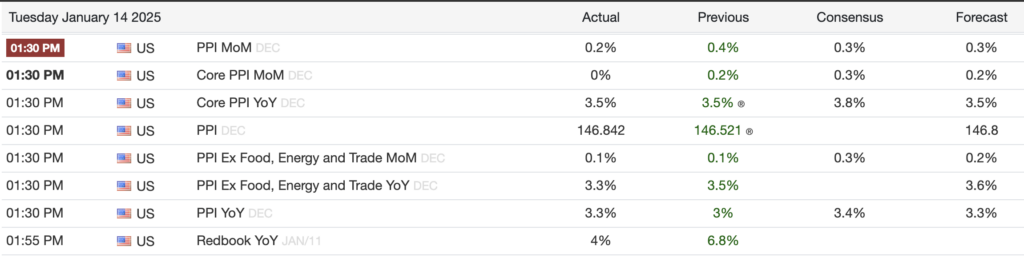

The monthly PPI rose 0.2% in December, below November’s 0.4% increase and in line with forecasts of 0.3%. Core PPI, which excludes volatile items such as food and energy, remained flat at 0% on a monthly basis, falling short of expectations. The annual Core PPI held steady at 3.5%, unchanged from the previous month, while the overall PPI index reached 146.842.

Bitcoin’s price remains within the $92,000 to $102,000 range established since mid-December, following its December 5 peak above $100,000. Despite fluctuations, it has demonstrated resilience amid mixed macroeconomic signals, including slowing inflationary pressures and shifting monetary policy expectations.

Market participants appear to be assessing the implications of PPI data for future Federal Reserve decisions. Bitcoin’s relatively stable performance suggests cautious optimism among investors as broader economic trends unfold.

Bitcoin began a V-shaped recovery after wicking down to $89,500 on Jan. 13. It reached as high as $97,000 immediately after PPI data was released before retracing slightly. As of press time, it is attempting to move higher below the $97,100 resistance.

The post Bitcoin holds near $96,500 as US PPI data shows slower producer price growth appeared first on CryptoSlate.