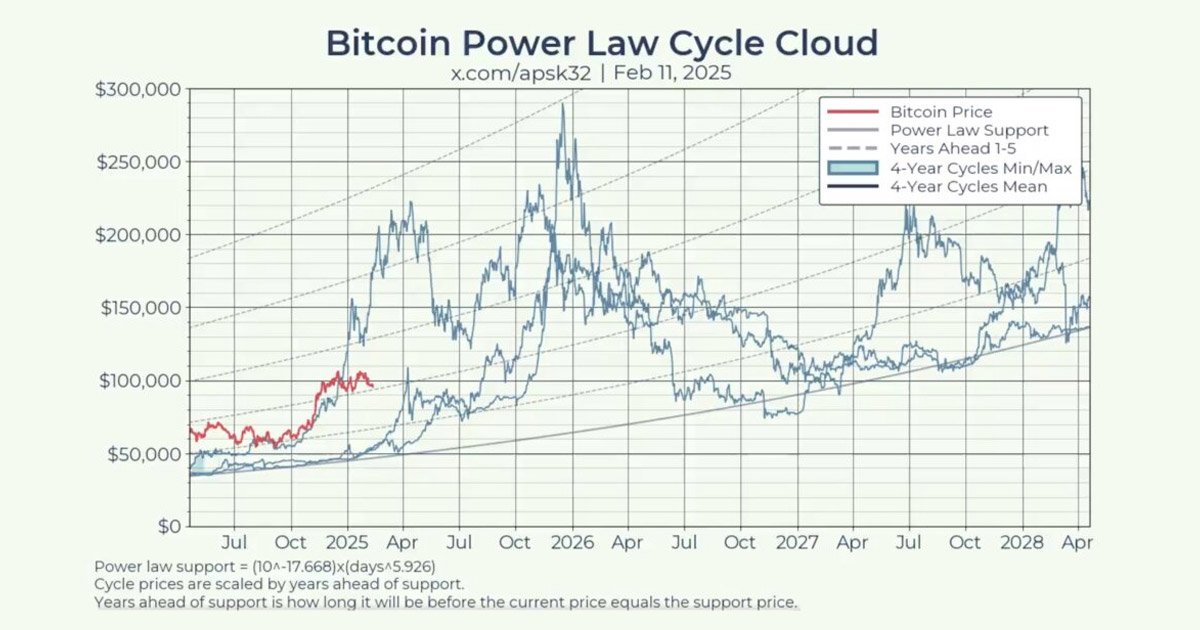

Bitcoin’s past cycles peaked in November or December, with peaks on Nov. 10, 2021, at $69,000; Dec. 17, 2017, at $19,891; and Nov. 29, 2013, at $1,242, according to analyst @apsk32, an engineer focused-on Bitcoin data visualization.

The data indicates that if historical trends persist, the four-year cycle pattern may signal a peak in November or December 2025.

For nearly 15 years, Bitcoin’s price has followed a power curve that some observers interpret as a support line representing the network’s intrinsic value when market sentiment subsides. The analysis uses a “years ahead” metric to gauge the period required for current prices to reach the support threshold before potential upward pressure resumes.

Bitcoin has previously risen above this trendline before returning to it during market downturns, as observed during the spring 2021 bull market, which concluded with a double top that realigned the cycle to a four-year timeframe.

Recent price action has followed a similar trajectory, although early ETF inflows have led to caution among market participants. A large segment of investors continues to hold coins in cold storage, citing the security benefits regardless of the cycle patterns.

The 4-year mean shows a peak of just over $200,000 around the end of 2025, with Bitcoin not falling below $70,000 ever again.

The post Bitcoin Power Law suggests November peak over $200,000 and never revisiting $70k appeared first on CryptoSlate.