As the United States prepares for Donald Trump’s inauguration on Jan. 20, interest in Bitcoin among US investors has increased significantly.

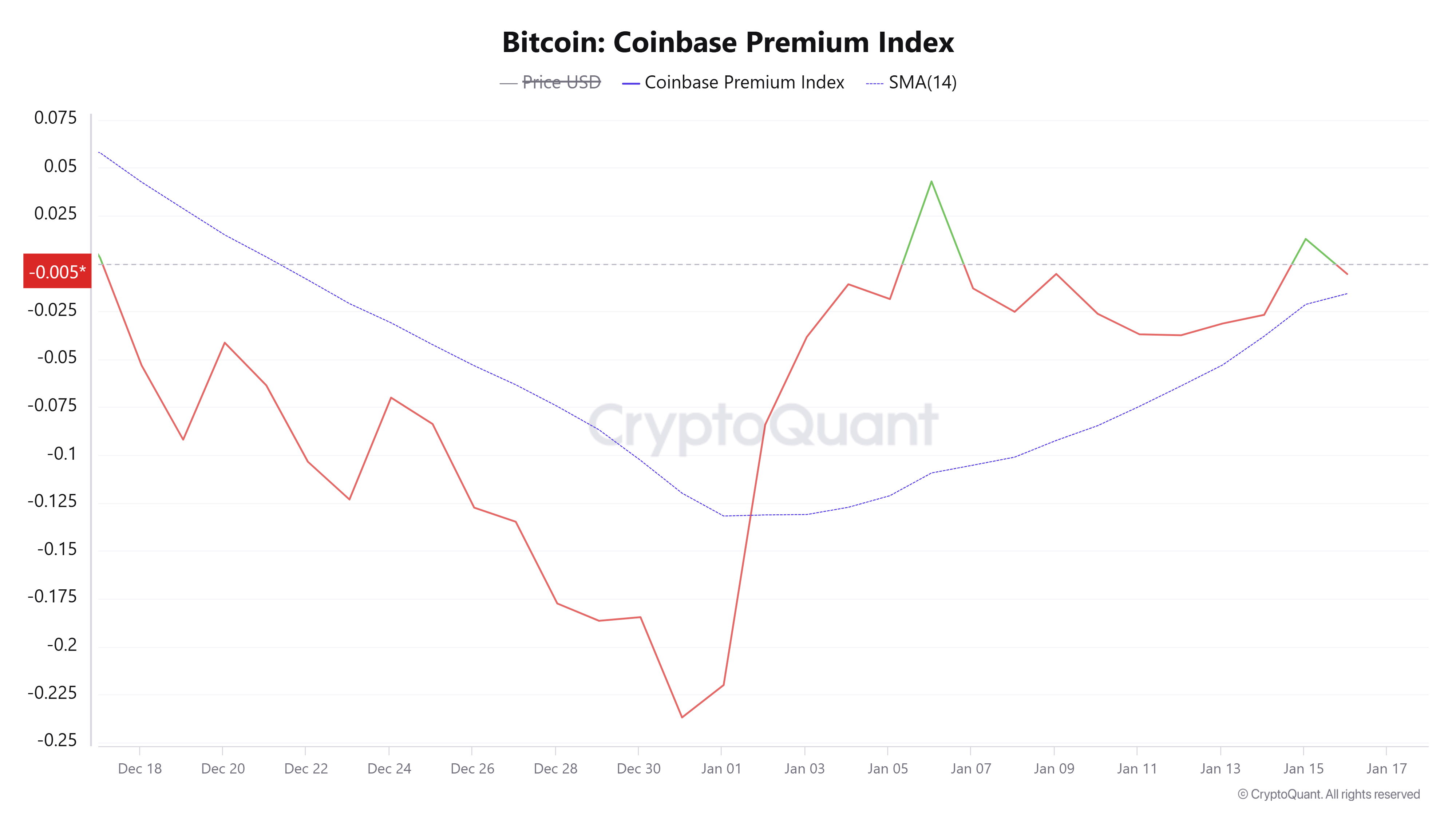

Data from CryptoQuant shows that the Coinbase Premium Index (CPI)—a key metric comparing Bitcoin prices on Coinbase and Binance—briefly turned positive on Jan. 16. This marked the first uptick since Jan. 6, signifying a momentary boost in demand for BTC on the US-based exchange.

Although the CPI has since dipped back into negative territory, other indicators suggest strong accumulation trends.

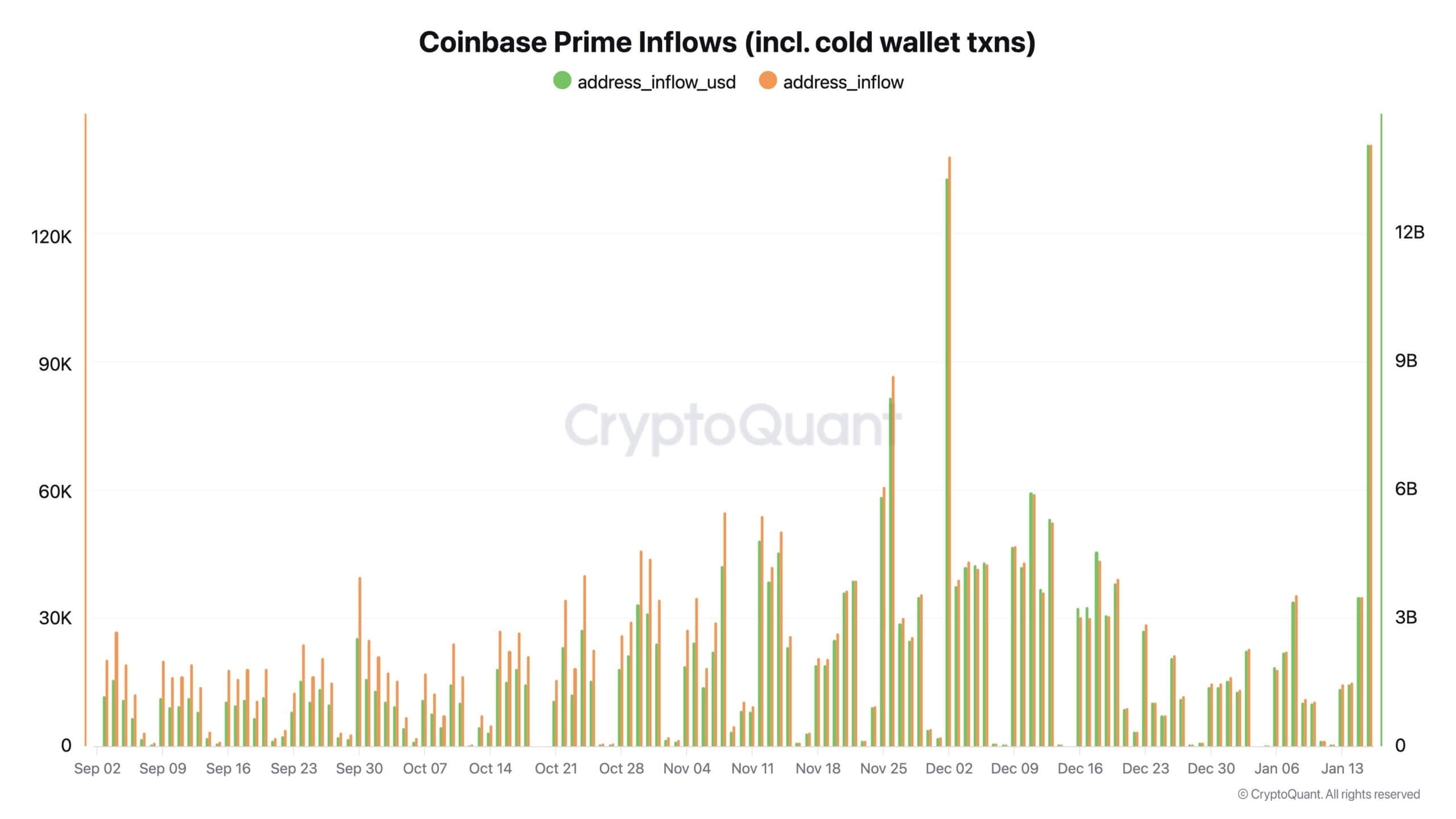

One such indicator is the rise in over-the-counter (OTC) trading on Coinbase Prime, a platform institutional investors prefer for large Bitcoin transactions. This activity signals growing interest from US-based institutions, further underscoring a bullish sentiment.

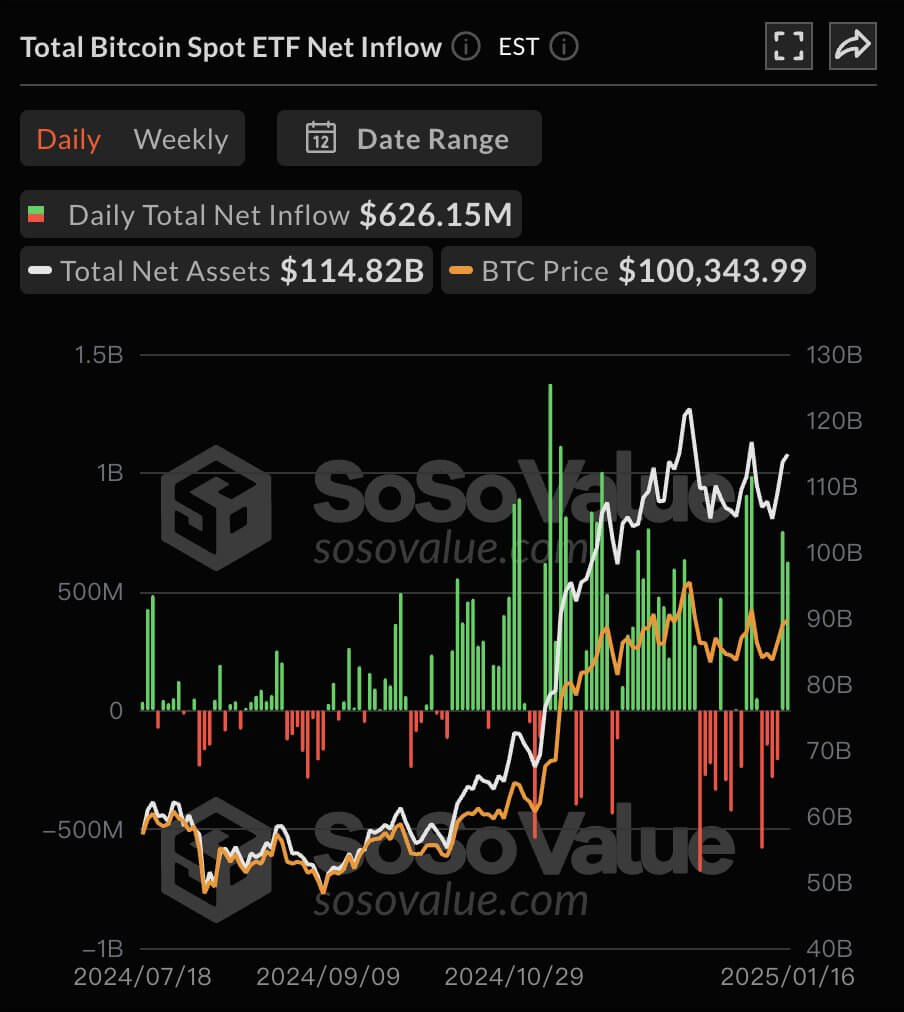

Additionally, US Bitcoin ETFs have seen a dramatic turnaround after experiencing four consecutive days of outflows totaling $1.2 billion. The 12 funds attracted over $1.3 billion in fresh investments within the last two days, signaling renewed investor confidence in the flagship digital asset.

Market analysts explain that the convergence of the increased Coinbase Premium activity, higher OTC trading, and significant ETF inflows highlights a concerted push by US investors to solidify their stake in the Bitcoin market.

This momentum could be critical in shaping Bitcoin’s price trajectory as the inauguration approaches. Notably, BTC’s price has risen more than 3% in the last 24 hours to $104,000 as of press time.

The post Bitcoin surges to $104k as US investors fuel buying spree before Donald Trump’s inauguration appeared first on CryptoSlate.