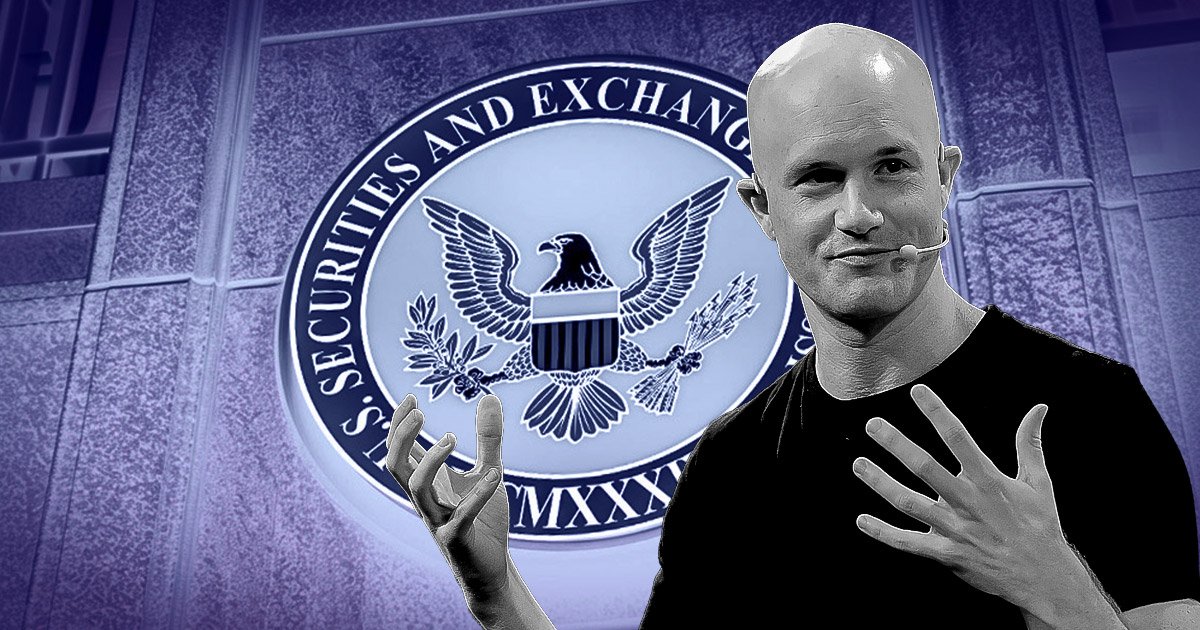

Coinbase CEO Brian Armstrong has called on the next Chair of the US Securities and Exchange Commission (SEC) to dismiss the agency’s “frivolous” cases against crypto firms and publicly apologize to the American people.

In an Oct. 29 post on X, Armstrong highlighted inconsistencies in the SEC’s approach to the crypto sector, which he argues have resulted in unnecessary lawsuits against companies such as Coinbase. He acknowledged that while an apology may not reverse the damage, it could be a step toward rebuilding public trust in the SEC.

He stated:

“It would not undue the damage done to the country, but it would start the process of restoring trust in the SEC as an institution.”

Conflicting SEC position

Under Gary Gensler‘s leadership, the SEC has issued conflicting statements on critical issues, including whether digital assets qualify as securities and the agency’s regulatory authority over digital asset exchanges.

Armstrong pointed out that in 2018, the SEC stated digital assets were not securities, only to contradict itself in 2021 by classifying them as investment contracts. By 2024, the agency had again shifted its position, stating that digital assets are “not securities.”

The SEC has also flip-flopped on Bitcoin’s status. Initially deemed a non-security in 2023, the SEC indicated uncertainty, eventually reaffirming its non-security classification in 2024.

Armstrong raised further concerns regarding the SEC’s authority over crypto exchanges. In 2021, the SEC claimed no regulatory body existed for these exchanges. A year later, however, it asserted that it held Congressional authority to oversee digital asset exchanges.

The SEC’s stance on securities law clarity has also been inconsistent. Although it previously claimed uncertainty about digital assets as securities, the agency argued in 2023 that its regulatory framework, established over the past 90 years, was clear.

These conflicting positions have led to industry-wide confusion and amplified calls for regulatory transparency. Many in the crypto space have advocated for SEC Chair Gensler’s removal, a move Republican presidential candidate Donald Trump has pledged to pursue if elected.

The post Coinbase CEO urges next SEC chief to apologize for crypto crackdown appeared first on CryptoSlate.