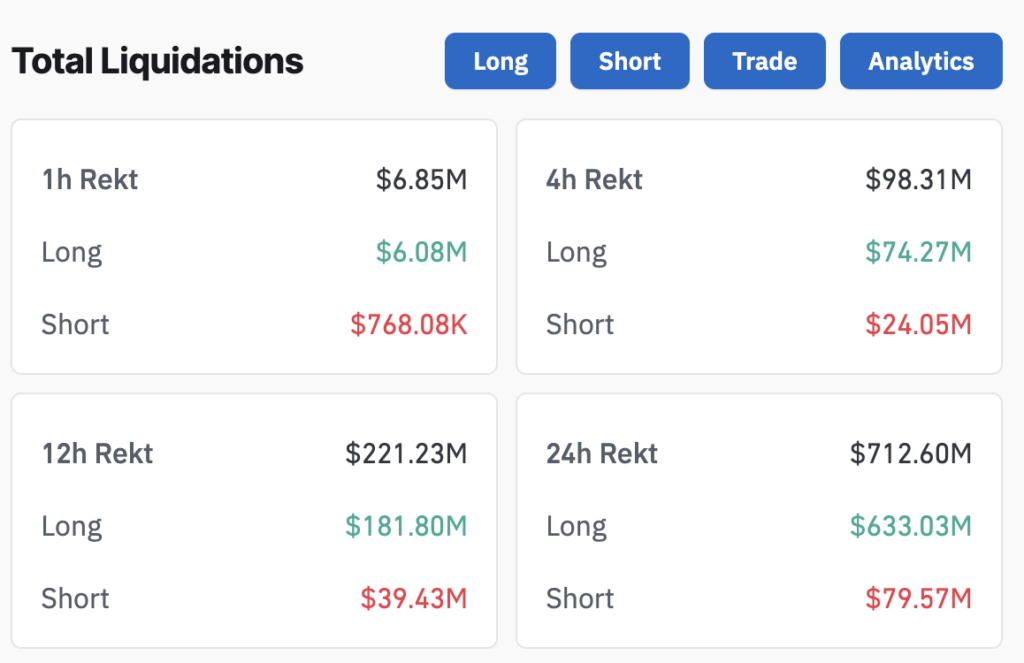

Over the past 24 hours, the crypto market experienced heightened volatility, leading to liquidations totaling $712 million across 237,375 traders, according to Coinglass data.

Long positions bore the brunt of the liquidations, accounting for 88.83% of the total, with $631.21 million cleared compared to $79.35 million in short positions. Bitcoin saw $130 million in liquidations, while Ethereum led with $150 million.

Binance recorded the highest activity, contributing $315.12 million in liquidations, including a single $17.74 million ETHUSDT liquidation, marking the largest order during this period.

Bitcoin’s price movements provided the backdrop for this liquidation surge, which began when the US stock market opened on January 8. Bitcoin traded around $102,500 early in the day before falling toward $100,000 as the US market opened.

The US stock market experienced a significant downturn on January 7, with all major indices closing lower. The S&P 500 fell 1.1%, losing 66.35 points to close at 5,909.03, while the Nasdaq Composite suffered the most significant decline, plummeting 1.9% or 375.30 points to finish at 19,489.68.

The price of Bitcoin followed traditional equities and sharply declined, dropping below $100,000. The downtrend continued into January 8, with Bitcoin touching lows near $95,300 as of press time.

The intense sell-off and liquidation cascade highlight market vulnerability, as traders miscalculated the strength of the correlation to the US market. Elevated trading volumes during the upward surge and subsequent sell-off suggest significant market activity, amplifying the impact of liquidations. The $102,393 resistance and $96,136 support levels, which Bitcoin has fallen below, remain critical markers as Bitcoin consolidates.

The post Crypto liquidations break $700 million as Bitcoin falls to $95k appeared first on CryptoSlate.