Ethereum has seen a sharp increase in the adoption of “blobs” over the past months, significantly impacting the blockchain network burn dynamics.

Blobs are temporary data packages that store large amounts of data off-chain. They were introduced with the EIP-4844 and designed to enhance Ethereum’s scalability by optimizing layer-2 operations without burdening the main blockchain.

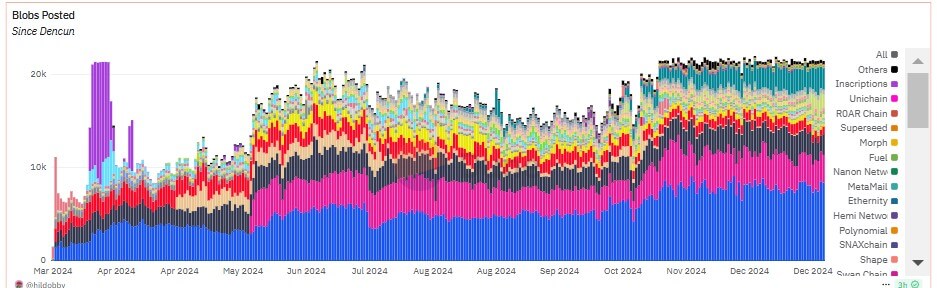

According to Dune Analytics data compiled by Hildobby, Ethereum has averaged more than 21,000 blobs daily over the past two months. This trend highlights a growing preference for layer-2 scaling solutions offering faster and more affordable transactions.

Meanwhile, the Blobs posting process incurs fluctuating costs based on network demand. According to GrowthePie data, blob-related fees on Ethereum reached approximately $4 million in the past month. These fees, paid in ETH, are burned, permanently removing the tokens from circulation and influencing the top crypto’s supply.

Essentially, the increased adoption of blobs has significantly impacted Ethereum’s ecosystem, particularly its ETH burn rates.

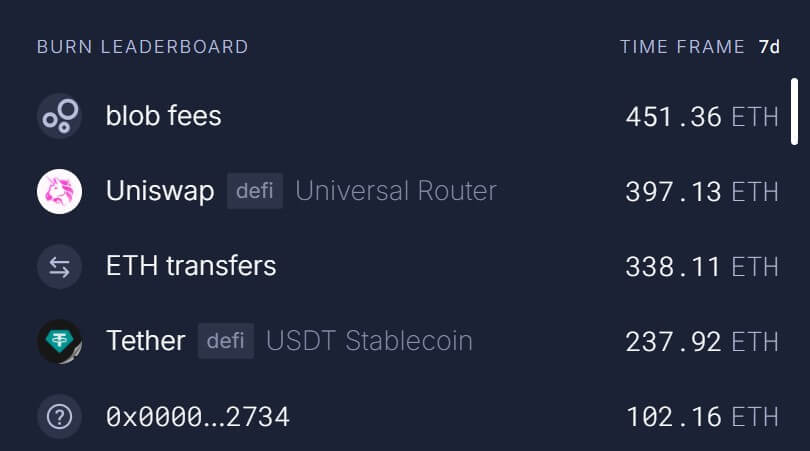

Over the past week, blobs emerged as the leading source of Ethereum burns, with 453.24 ETH burned, according to Ultrasound.money. This figure surpasses the 396 ETH burned by Uniswap, Ethereum’s largest decentralized exchange protocol, over the same period.

However, when examining a 30-day window, Uniswap remains the top ETH burner, contributing to 4,681 ETH burns compared to the 1,068 ETH burned through blobs.

The post Ethereum’s blob adoption sparks rise in ETH burns, surpassing Uniswap appeared first on CryptoSlate.