MicroStrategy has expanded its Bitcoin reserves for the tenth consecutive week by acquiring 2,530 BTC for $243 million, according to a Jan. 13 filing with the US Securities and Exchange Commission (SEC).

This purchase, at an average price of $95,972 per Bitcoin, boosts MicroStrategy’s total Bitcoin holdings to 450,000 BTC.

The total cost of MicroStrategy’s Bitcoin purchases is $28.2 billion, at an average cost of $62,691 per BTC. At current market valuations, these holdings are worth over $40 billion, delivering an unrealized gain of $12.7 billion.

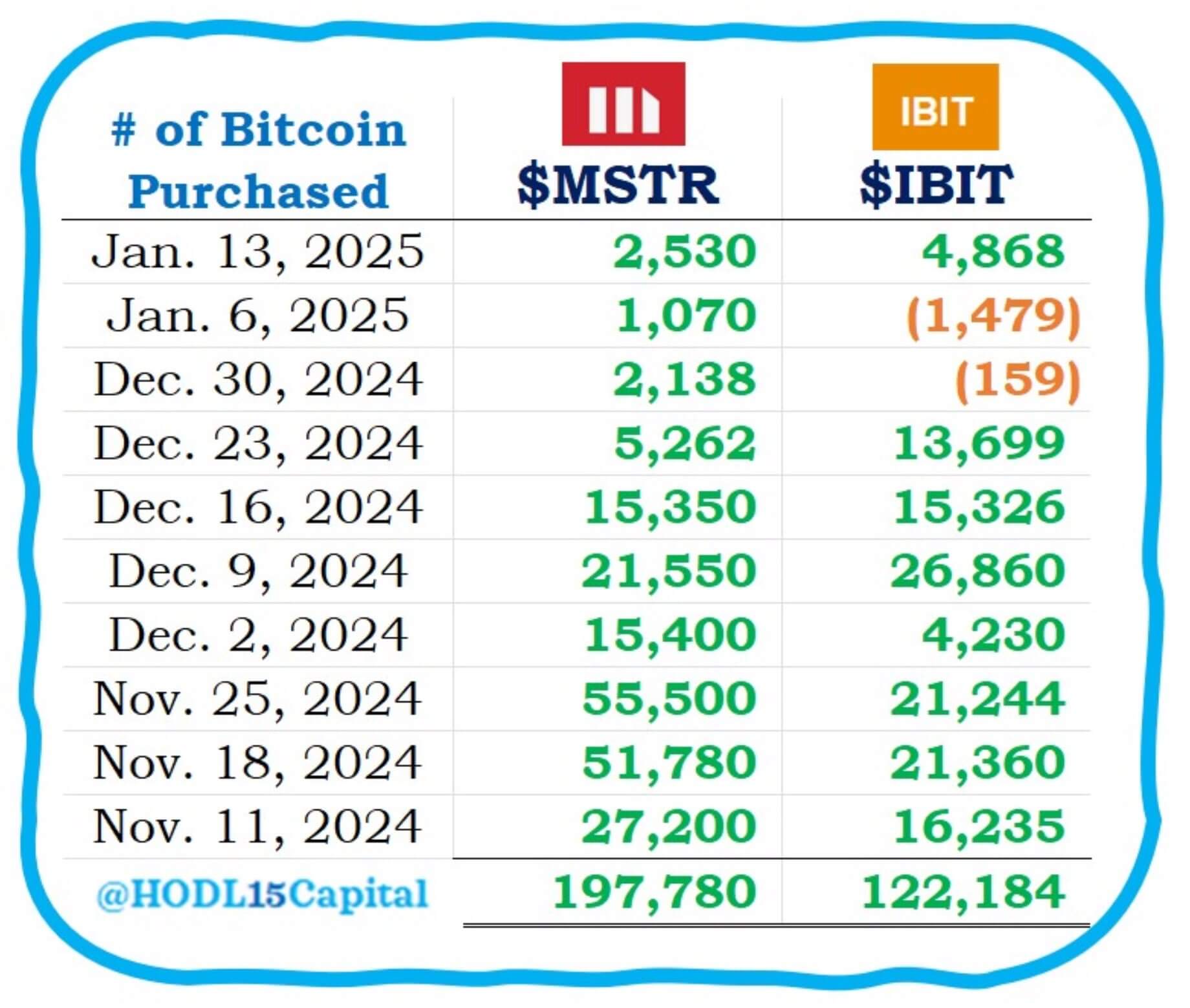

In the past 10 weeks alone, the Michael Saylor-led company has added nearly 200,000 BTC to its portfolio, significantly outpacing the largest spot, Bitcoin ETF BlackRock’s IBIT, which acquired around 120,000 BTC within the same timeframe.

Despite the milestone, market reactions have been mixed. According to Google Finance’s data, MicroStrategy’s stock price fell 5% during premarket trading to $310, mirroring BTC’s downturn.

The top crypto now trades just above the $90,000 mark, down more than 4% in the last 24 hours, according to CryptoSlate’s data.

The post MicroStrategy’s 10-week Bitcoin buying spree surpasses BlackRock’s IBIT with nearly 200,000 BTC added appeared first on CryptoSlate.