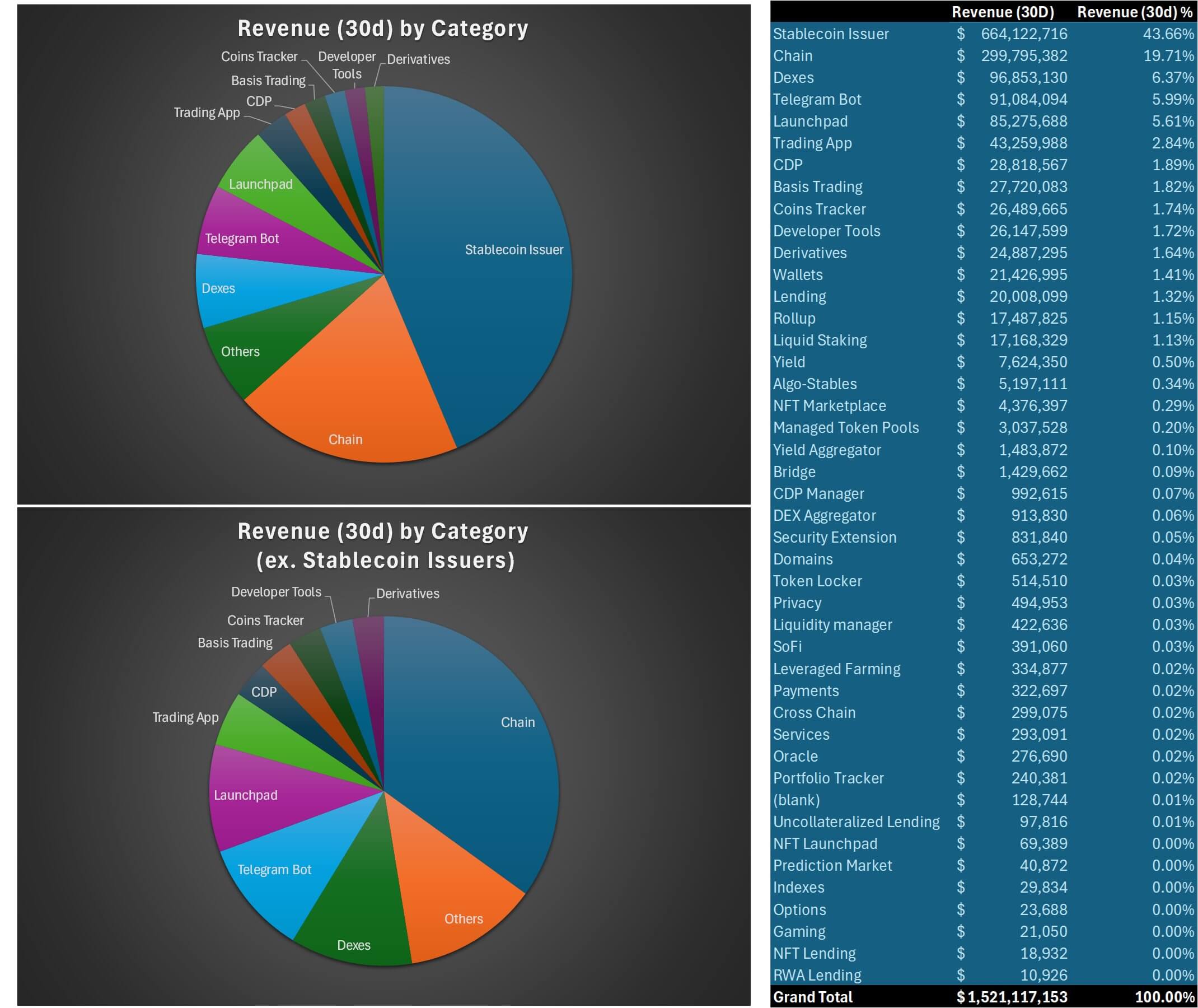

The crypto industry saw significant on-chain revenue in December, with stablecoin issuers taking the lion’s share, according to data from DeFiLlama.

These issuers collectively earned over $664 million, representing over 40% of the $1.5 billion total revenue generated by crypto protocols.

Tether, the USDT stablecoin issuer, emerged as the top contributor, pulling in $532.10 million. Circle, the USDC issuer, followed with $132.77 million.

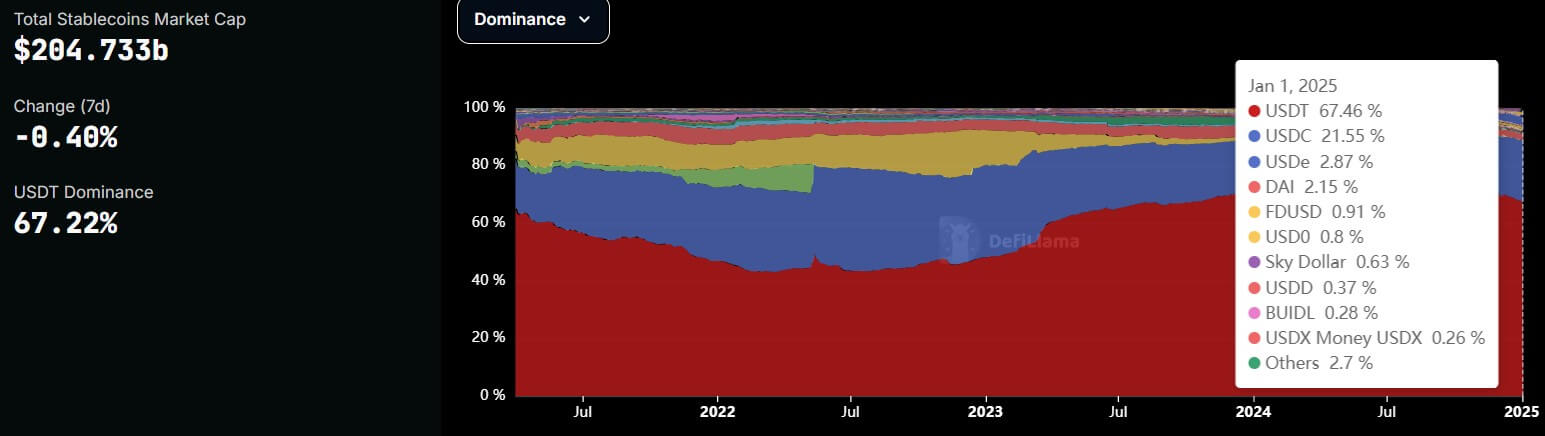

Together, these two issuers dominate the stablecoin sector, accounting for nearly 90% of the market, which is valued at over $200 billion.

Stablecoins continue solidifying their role as one of the most practical crypto products. Their price stability shields users from the volatility typical in other digital assets, making them a preferred choice for traders and a gateway to the US dollar in emerging markets.

Market predictions suggest that the stablecoin market could grow to $400 billion by 2025, presenting substantial profit opportunities that have attracted new entrants like Ripple and BitGo.

The post Tether and Circle generate $664 million in December revenue commanding stablecoin market appeared first on CryptoSlate.