Bitcoin’s pullback to $90,000 caused quite a stir in the market. Although its recovery to above $96,000 on Jan. 14 offered some relief, many on-chain indicators revealed underlying stress in market health.

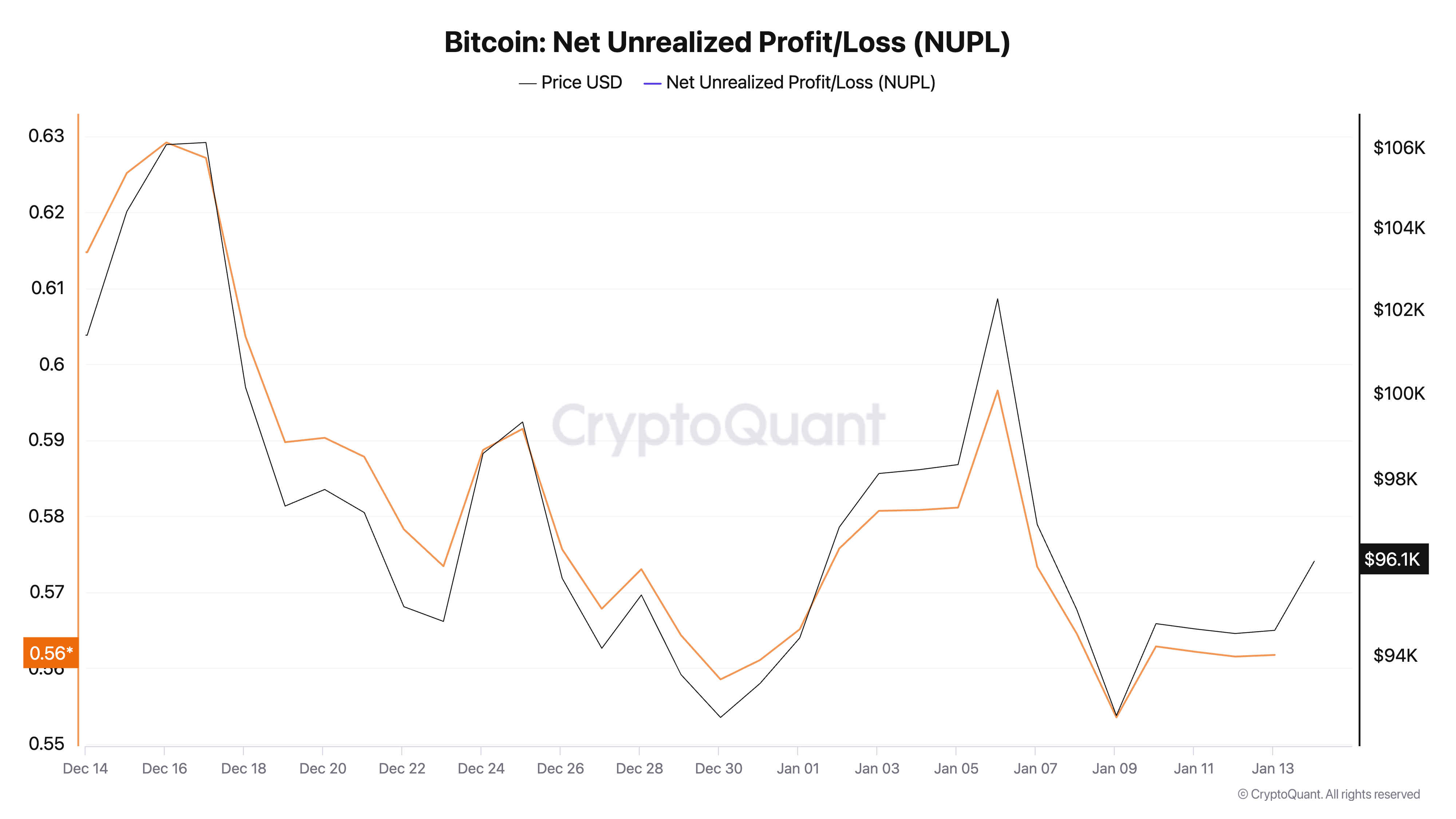

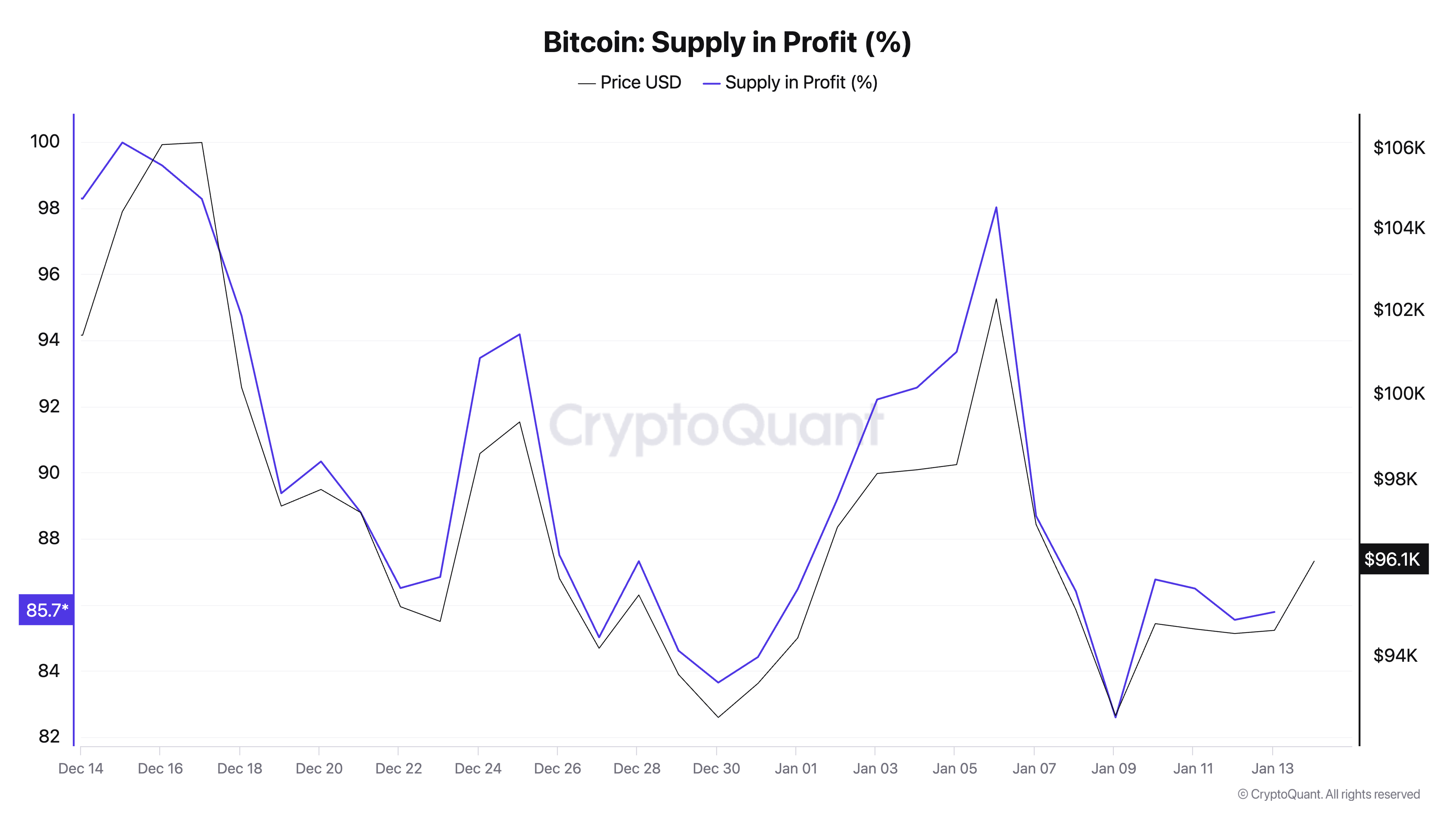

Key metrics like Net Unrealized Profit/Loss (NUPL) and the percentage of supply in profit showed significant declines over the past week, reflecting shifts in the market’s unrealized gains and losses.

NUPL, a metric calculated as the difference between unrealized profits and unrealized losses divided by the total market value, serves as a barometer for market sentiment. A positive NUPL indicates that the market is in a state of unrealized profit, suggesting optimism among holders.

Over the past week, NUPL dropped from 0.615 to 0.562, signaling a moderate reduction in aggregate unrealized gains. This decrease reflects a cooling of market exuberance, but the NUPL’s position firmly in positive territory suggests that significant unrealized profits still support the market structure. A drop of this magnitude (–0.053) indicates a softening in sentiment rather than a fundamental shift.

The percentage of Bitcoin’s supply in profit is calculated by comparing the acquisition cost of coins with current market prices. It dropped sharply from 98.52% to 85.78% over the past week, revealing that a substantial portion of Bitcoin’s supply moved from unrealized profit to unrealized loss due to price fluctuations.

On Jan. 13, 85.78% of Bitcoin’s supply was still in profit, indicating that most holders acquired their Bitcoin at prices below the current market price. This shows that despite the market being highly sensitive to price volatility, a large proportion of it still remains resilient.

These metrics are crucial in understanding Bitcoin’s cost-basis distribution and overall market health. NUPL and supply in profit collectively highlight the economic positioning of Bitcoin holders. While 14.2% of Bitcoin’s supply now has a cost basis above the current price, the data indicates robust underlying support for Bitcoin’s price to remain above $90,000. This further confirms that the market has not entered a prolonged distribution phase.

Supply in profit and NUPL measure the relationship between historical acquisition costs and current prices but do not account for actual trading activity or behavior. For instance, while a decline in unrealized profits might suggest increased selling pressure, these indicators cannot confirm whether holders are actively selling or simply holding through volatility.

These metrics offer a macro-level view of the market’s cost basis, acting as a “thermometer” for Bitcoin’s economic positioning. The data reinforces the view that most Bitcoin holders are still in profit, a factor that can provide stability in times of price turbulence.

While the sharp drop in unrealized profits might raise concerns about increased selling pressure, the resilience in the percentage of supply in profit suggests a strong base of holders who remain optimistic about Bitcoin.

The post The market is still in profit despite Bitcoin’s price slump appeared first on CryptoSlate.