Solana’s decentralized exchange (DEX) ecosystem saw unprecedented activity over the weekend, driven by the launch of US President-elect Donald Trump’s official memecoin on the blockchain.

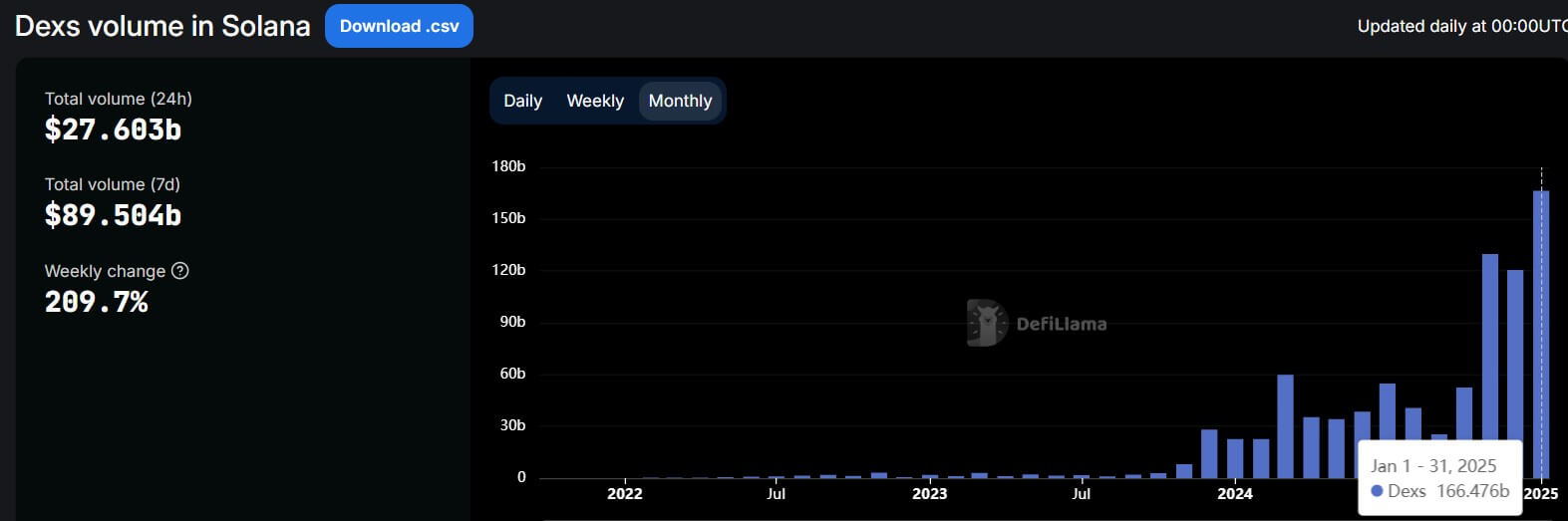

According to DefiLlama data, Solana’s DEX volume set consecutive all-time highs. It recorded $16.87 billion on Jan. 17, $28.28 billion on Jan. 18, and $27 billion on Jan. 19.

As of Jan. 20, the platform’s DEX trading volume stood at $27.6 billion.

These numbers mark a remarkable surge for a blockchain network and represent about 10% of the daily trading volume of NASDAQ, which averages over $300 billion.

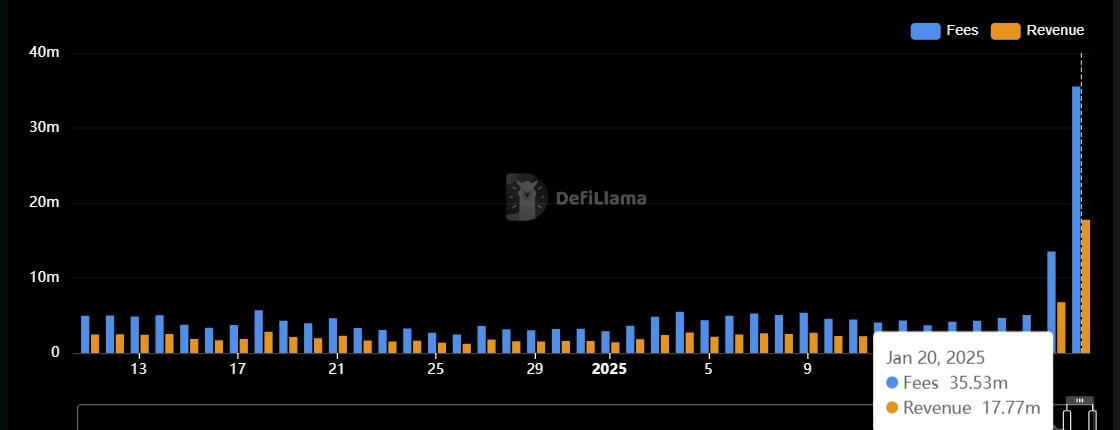

These surges propelled Solana’s monthly trading volume to over $166 billion, the highest in its history. Alongside this, DeFillama data shows that the network generated more than $35 million in fees as of Jan. 20.

Meanwhile, the network’s success extended to its native token, SOL, which reached an all-time high of $275 on Jan. 19.

Mert Mumtaz, CEO of Helius Labs, noted that the numbers show how Solana is redefining market conditions. According to him:

“We’ve made insane progress. Solana DEXes are flipping traditional stock exchanges, solana apps are placing in the top 10 of global app stores, and literal presidents of entire countries are launching their tokens on solana.”

The post Trump’s memecoin catapults Solana DEX activity to match 10% of Nasdaq’s daily volume appeared first on CryptoSlate.