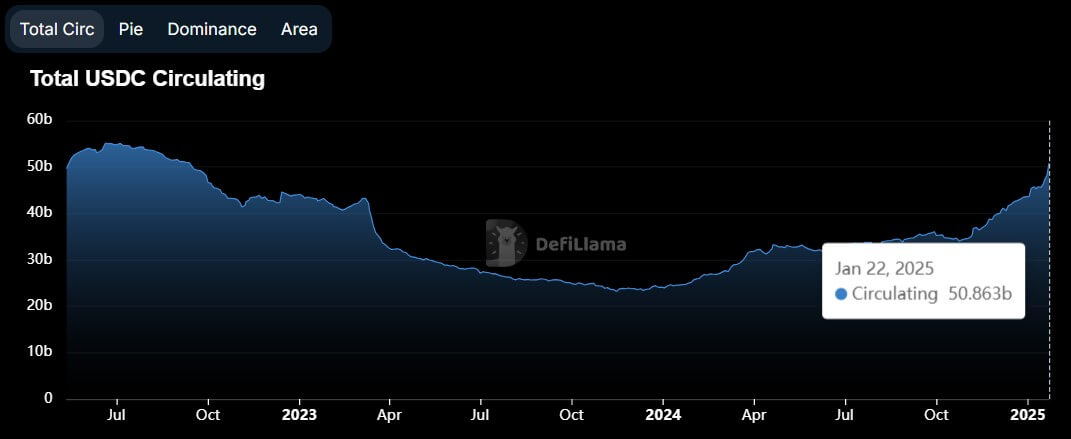

Circle’s USD Coin (USDC) has achieved a major milestone, with its circulating supply surpassing $50 billion for the first time in three years.

DeFillama’s data shows that USDC’s supply hit approximately $51 billion on Jan. 22, marking a sharp recovery from its 2023 low of under $24 billion.

Although this represents a significant growth for the digital asset, the stablecoin remains 10% below its all-time high of $55.9 billion recorded in mid-2022. Meanwhile, the distribution of USDC across blockchain networks have undergone significant changes during the last three years.

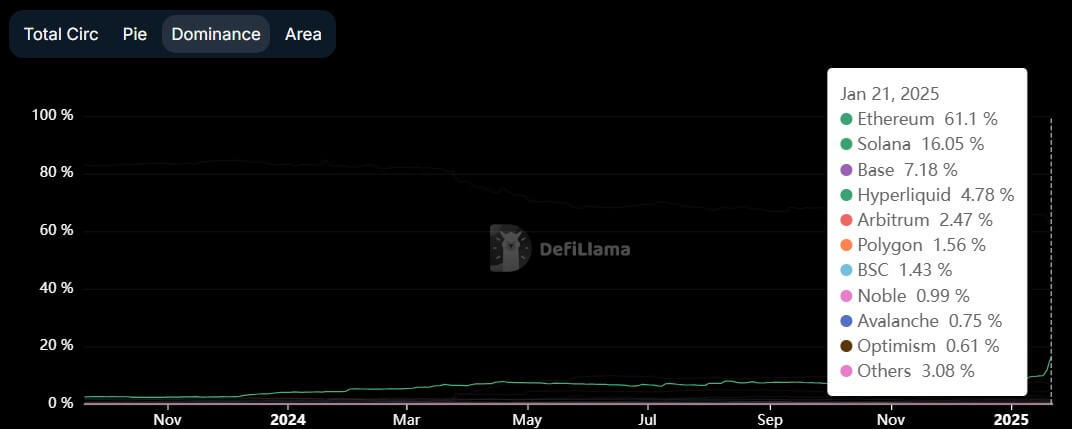

While Ethereum remains a key player, its share of USDC’s supply has dropped from 85% to 61%. At the same time, Solana’s share has increased to 16% from less than 3%.

This trend highlights a shift as traders opt for Solana’s lower transaction costs, particularly for speculative trades involving memecoins and AI-related tokens.

Additionally, the emergence of new blockchain platforms like the Coinbase-backed Base — an Ethereum layer-2 network solution — and Layer 1 networks like Hyperliquid have contributed significantly to this shift.

These platforms offer faster and more cost-effective alternatives and appeals to users seeking efficient trading solutions.

The post USDC supply surpasses $50 billion as users increasingly prefer Solana blockchain appeared first on CryptoSlate.